Payroll calculator wa

Discover ADP Payroll Benefits Insurance Time Talent HR More. Receipt of payment of amounts due deceased employees.

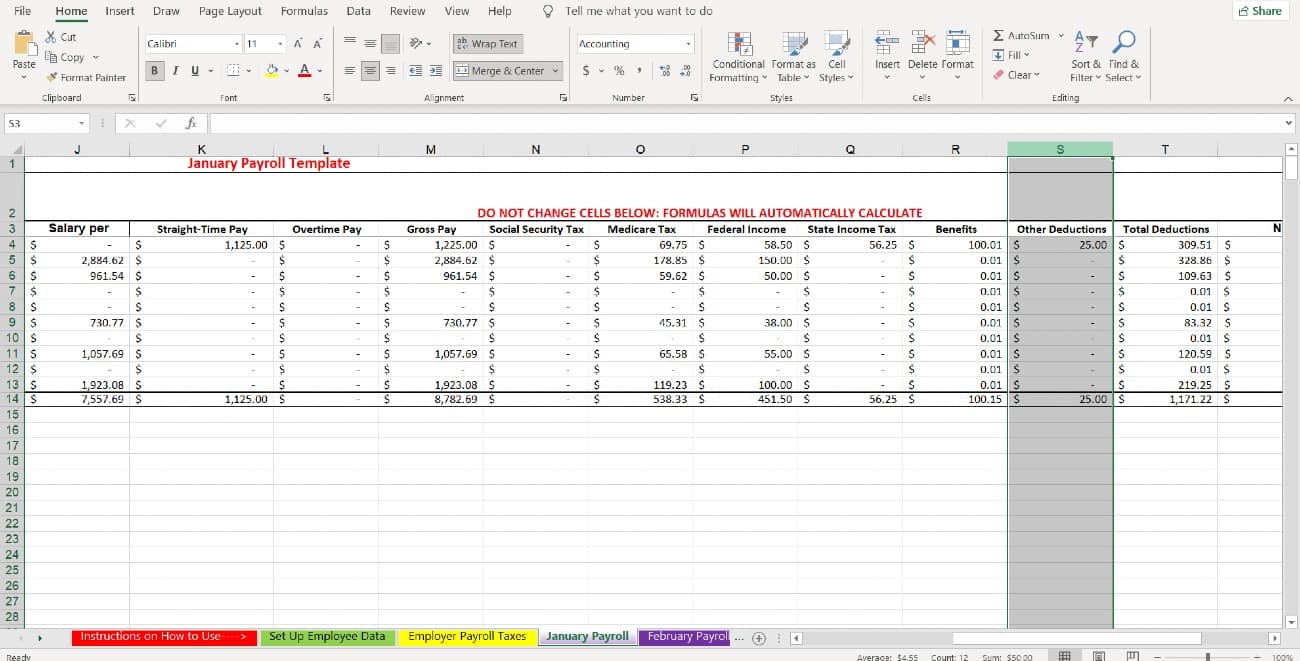

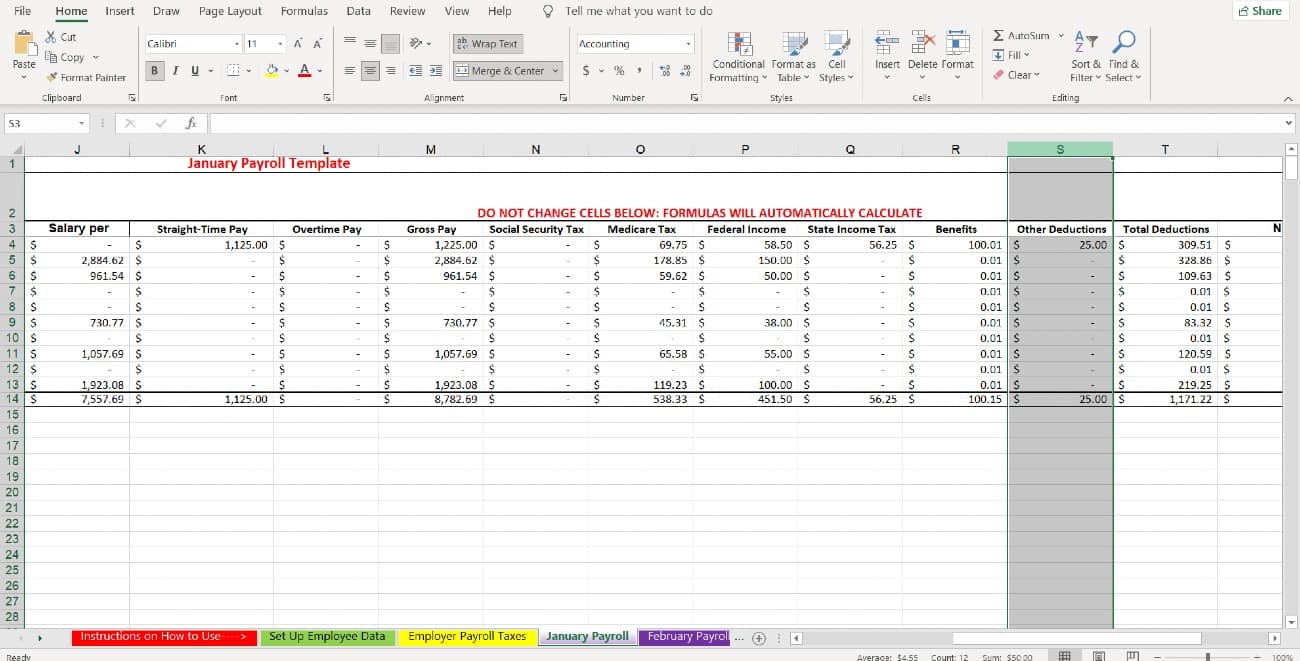

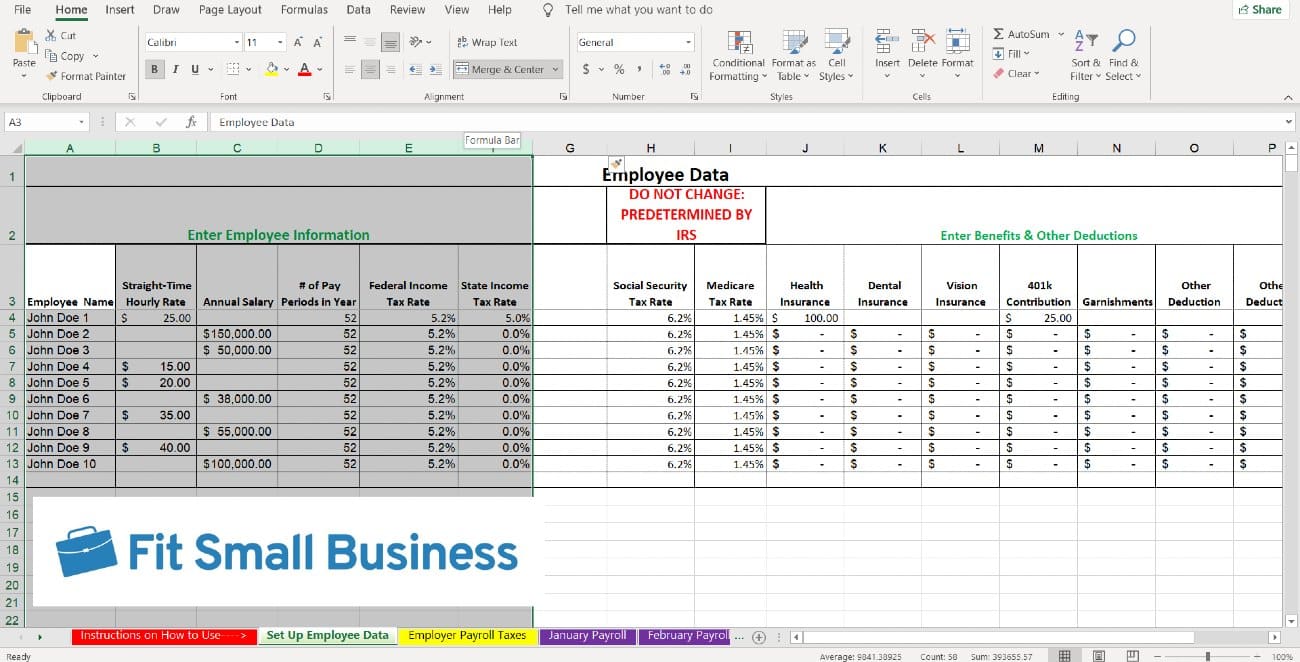

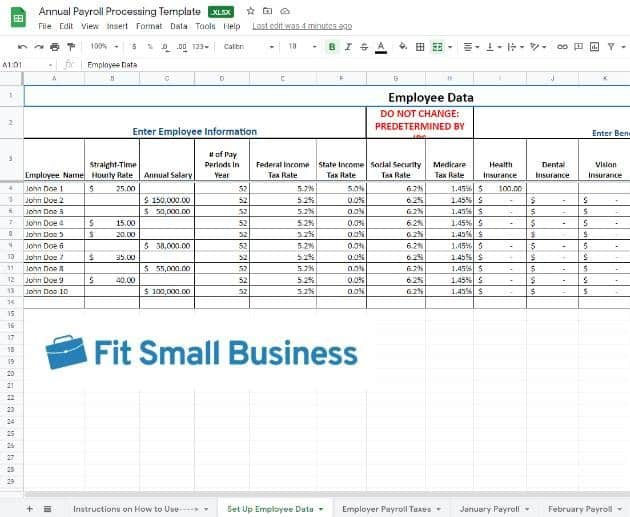

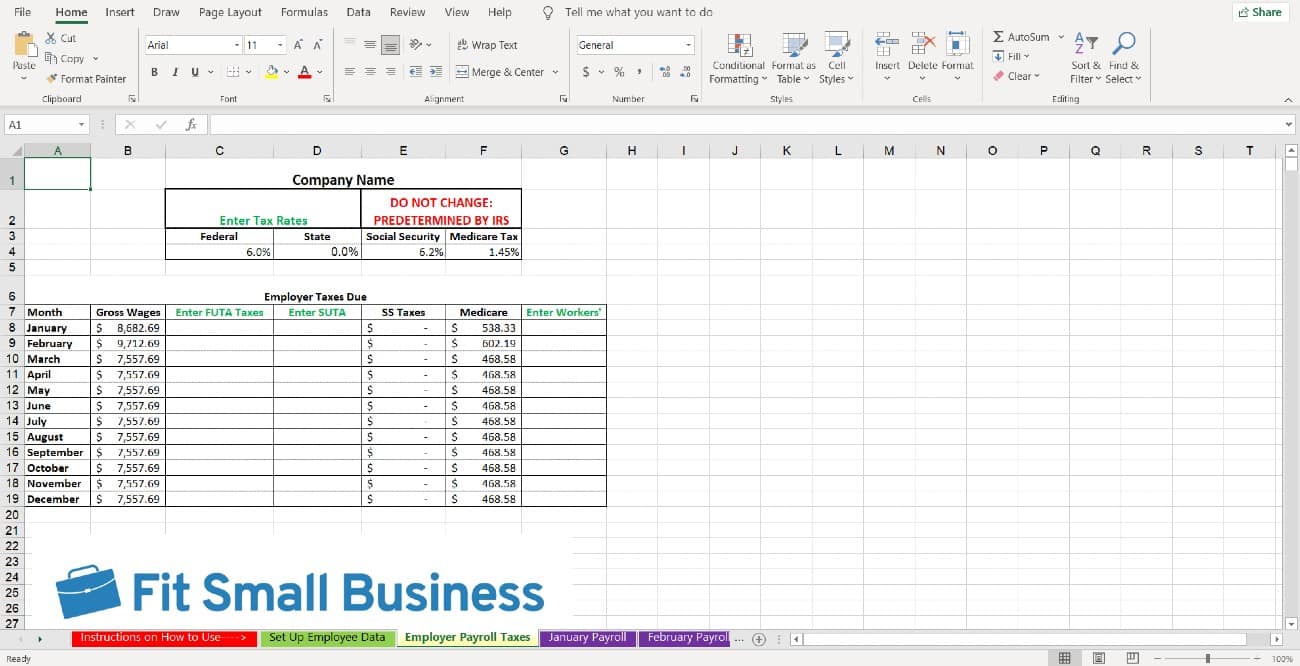

How To Do Payroll In Excel In 7 Steps Free Template

Of this employers with 50 employees will pay up to 2678 and employees will pay 7322.

. Figure out your filing status work out your adjusted gross. Get your payroll done right every time. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

Washington Hourly Paycheck Calculator Results. Washington Washington Gross-Up Calculator Change state Use this Washington gross pay calculator to gross up wages based on net pay. Ad Compare This Years Top 5 Free Payroll Software.

Washington Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and. Washington Paycheck Calculator - SmartAsset SmartAssets Washington paycheck calculator shows your hourly and salary income after federal state and local taxes. Get Started With ADP Payroll.

Calculate your payroll tax liability Calculate your payroll tax liability This calculator can assist you with estimating your payroll tax liability. Below are your Washington salary paycheck results. Pay employee premiums on their behalf.

Features That Benefit Every Business. Washington Salary Paycheck Calculator Change state Calculate your Washington net pay or take home pay by entering your per-period or annual salary along with the pertinent federal. The premium rate is 06 percent of each employees gross wages not including tips up to the 2022 Social Security cap 147000.

Ad Process Payroll Faster Easier With ADP Payroll. Just enter the wages tax. Discover ADP Payroll Benefits Insurance Time Talent HR More.

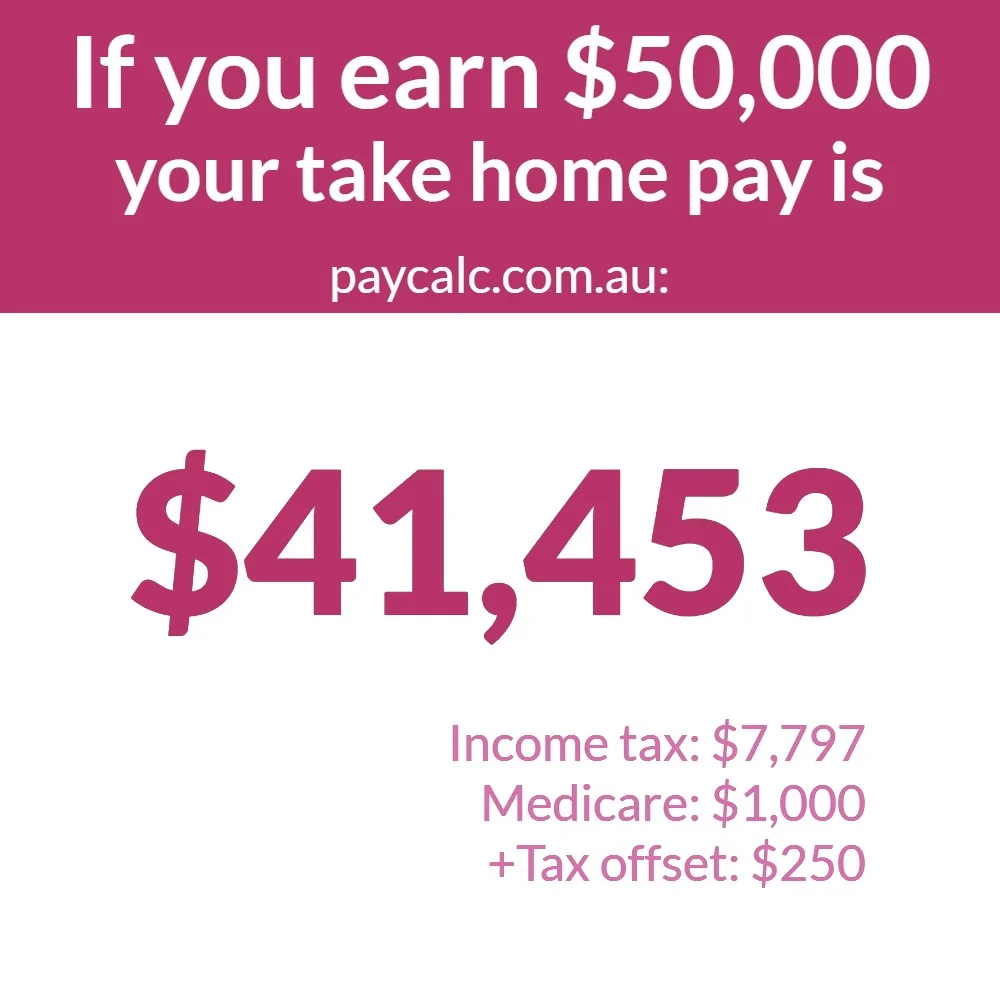

Free Unbiased Reviews Top Picks. Simply enter their federal and state W-4 information. Use this calculator to quickly estimate how much tax you will need to pay on your income.

It is not a substitute for the. Ad Process Payroll Faster Easier With ADP Payroll. Ad Payroll Made Easy.

Collect employee premiums OR. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year. The results are broken up into three sections.

Ad Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Ad Run your business. For example if you earn 2000week your annual income is calculated by.

Employers can withhold up to 7322 of the total. Direct deposit - authorization for automated clearing house. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Washington.

Based Specialists Who Know You Your Business by Name. Get Started With ADP Payroll. Enter your info to see.

Washington Paycheck Calculator Use ADPs Washington Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. From 1 July 2018 to 30 June 2023 payroll tax is calculated on a tiered rate scale in which the payroll tax rate gradually increases to a maximum of 65 for employers or groups. EzPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

This calculator is always up to date and conforms to official Australian Tax Office rates and. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Washington residents only. It will confirm the deductions you include on your.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. All employers may either withhold employees premiums from their paychecks or pay some or all of the premium on their employees behalf. Well run your payroll for up to 40 less.

Calculating your Washington state income tax is similar to the steps we listed on our Federal paycheck calculator. Payroll tax is assessed on. For example if an employee receives 500 in.

This calculator uses the 2019 cap at 132900. Big on service small on fees. Paycheck Results is your gross pay.

How To Do Payroll In Excel In 7 Steps Free Template

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Washington Paycheck Calculator Adp

How To Read Your Payslip Integrated Service Center

Washington Paycheck Calculator Smartasset

Payroll Tax Calculator For Employers Gusto

Here S How Much Money You Take Home From A 75 000 Salary

Washington Paycheck Calculator Smartasset

Indeed Salary Calculator Indeed Com

Calculating Payroll For Employees Everything Employers Need To Know

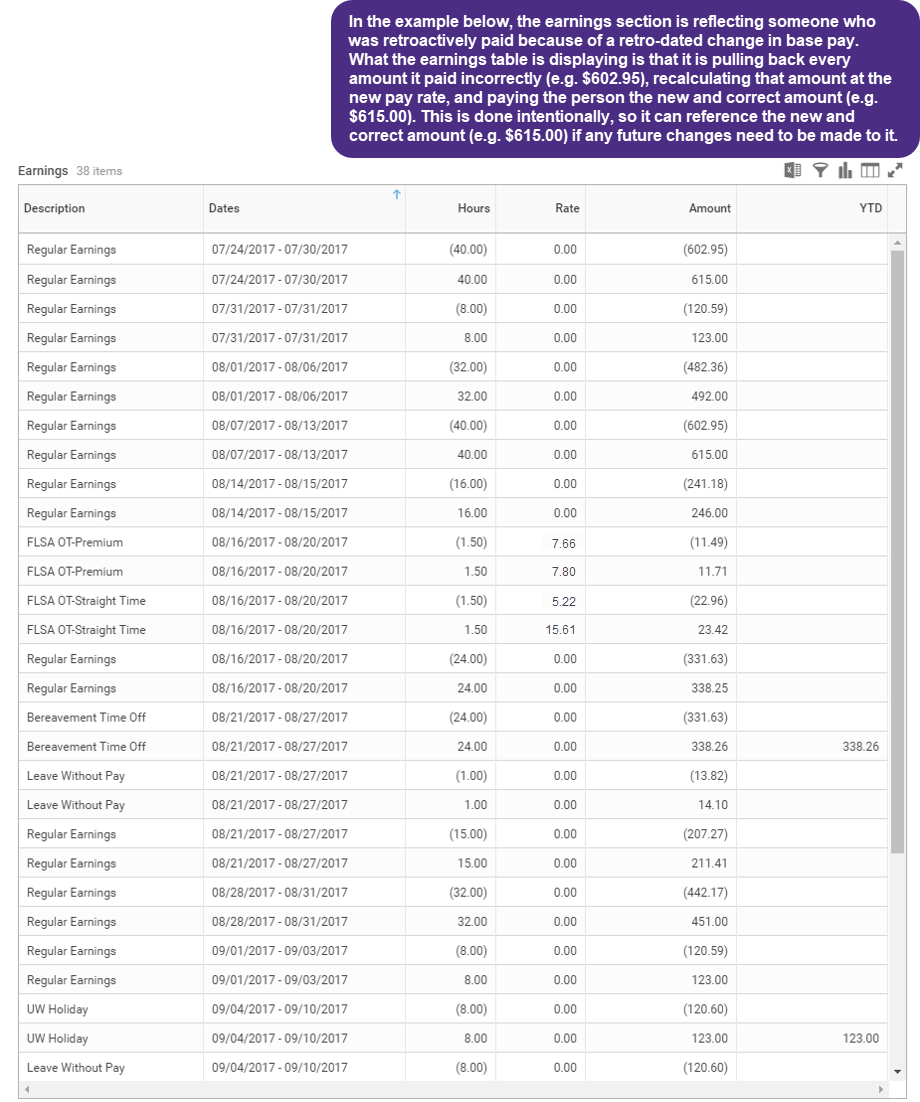

Hrpaych Yeartodate Payroll Services Washington State University

Here S How Much Money You Take Home From A 75 000 Salary

How To Do Payroll In Excel In 7 Steps Free Template

How To Do Payroll In Excel In 7 Steps Free Template

Pay Calculator

How To Calculate Payroll Taxes Methods Examples More

How To Do Payroll In Excel In 7 Steps Free Template